Società immobiliare privata

Arrow Capital Partners

Chi siamo

Siamo specializzati in opportunità di value add e riposizionamento in più settori e asset class, investendo sia in equity che in debito.

Arrow Capital Partners è una società di investimenti privati specializzata in opportunità di valore aggiunto e riposizionamento di immobili commerciali e investe in titoli azionari e di debito.

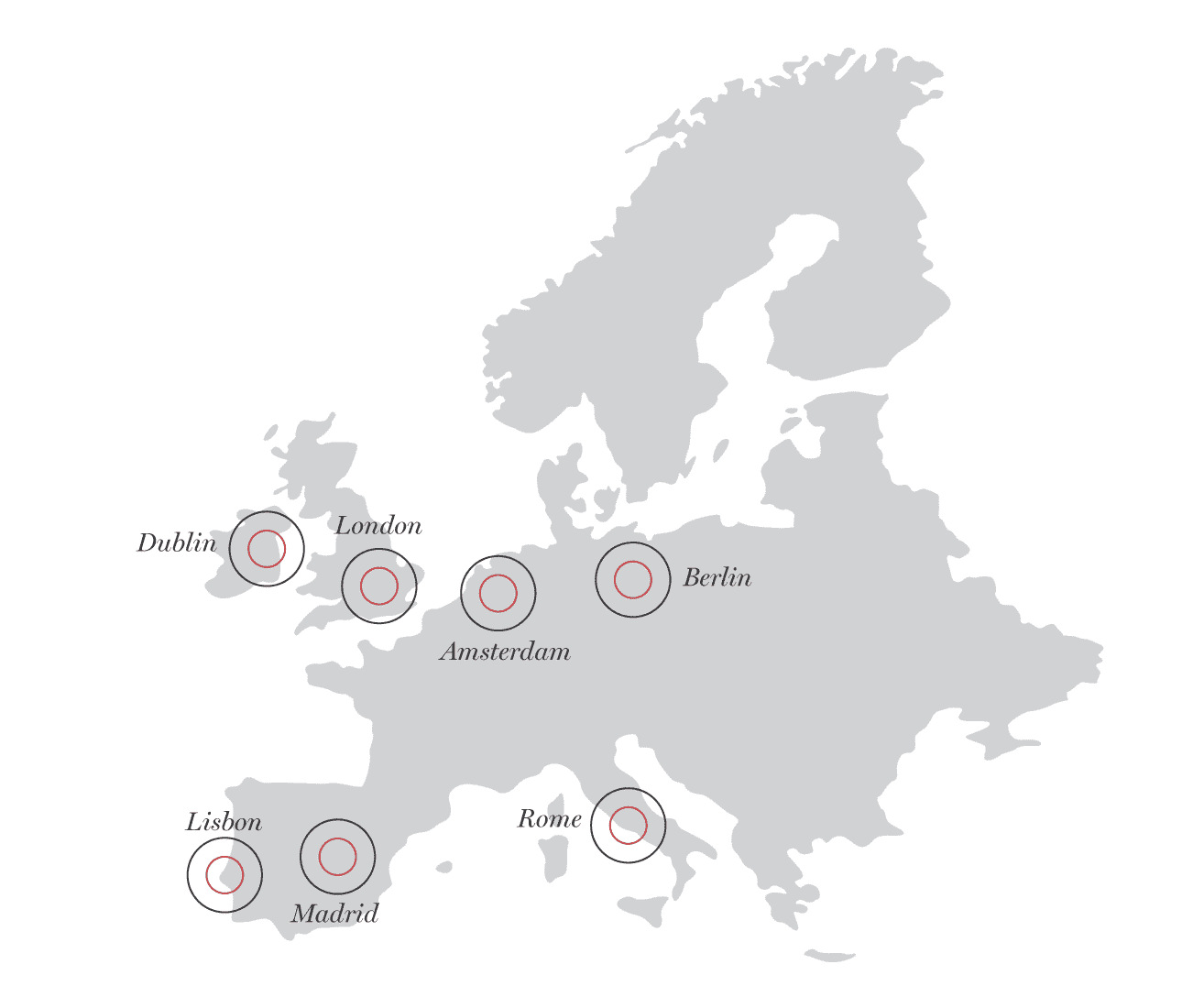

Con 12 sedi dislocate in Europa e nella regione Asia-Pacifico, Arrow gestisce asset per un valore immobile di 5 miliardi di dollari. Esercitando sul mercato tanto il ruolo di investitori quanto di operatori, ricerchiamo opportunità invitanti e offriamo soluzioni a capitale misto, sfruttando il nostro capitale personale e quello dei nostri investitori di fiducia.

Ciascun partner di Arrow Capital vanta oltre 20 anni di esperienza nel settore immobile a livello globale, possedendo e gestendo alcune delle piattaforme di investimento indipendente e gestione dei beni più grandi in Asia-Pacifico ed Europa, e gode inoltre di profonda stima tra investitori istituzionali e di private equity in tutto il mondo.

Cosa ci distingue

La nostra partnership si fonda su un approccio agli investimenti di tipo imprenditoriale e disciplinato.

In quanto partnership privata con un forte intuito commerciale, una profonda conoscenza delle macro tendenze e una radicata esperienza sul campo in ogni mercato in cui investiamo, abbiamo la capacità di agire in modo deciso e di rispondere tempestivamente alle opportunità quando si presentano.

Con investimenti personali importanti nei progetti che gestiamo, i nostri obiettivi vanno di pari passo a quelli dei nostri partner investitori. Ciò si traduce in un’attenzione costante verso la trasparenza e le prestazioni in ogni fase dell’investimento e fino alla sua conclusione.

Le nostre capacità

Siamo noti per essere investitori immobiliari pratici e reattivi.

Il nostro modello di investimento in beni immobili e di gestione di tipo “end-to-end” è sinonimo di coinvolgimento attivo in ogni fase del processo, dalla selezione degli asset da acquisire, alla creazione, implementazione e consegna di strategie e piani per gli asset, e fino all’approvazione di locazioni e costi di capitale.

Negli ultimi nove anni, i nostri partner hanno coordinato 15 miliardi di dollari in investimenti nella regione Asia-Pacifico e 10 miliardi di dollari in investimenti e acquisizioni in Europa. Arrow vanta un team di 50 professionisti in investimenti, gestione degli asset e finanza tra Europa e Asia-Pacifico.

Abbiamo sancito relazioni professionali con un’ampia gamma di partner di investimenti tra cui:

- Istituti globali

- Private equity

- Manager di fondi

- Family office

- Investitori privati

Tipologie di investimenti:

- Investimenti in logistica

- Investimenti core plus e a valore aggiunto

- Lanci di fondi e mandati per conti separati

- Sviluppi residenziali

- Gestione di piattaforme di management di investimenti immobiliari

- Attività aziendali

- Debito

- Sviluppo immobiliare

- Uffici

Filter location:

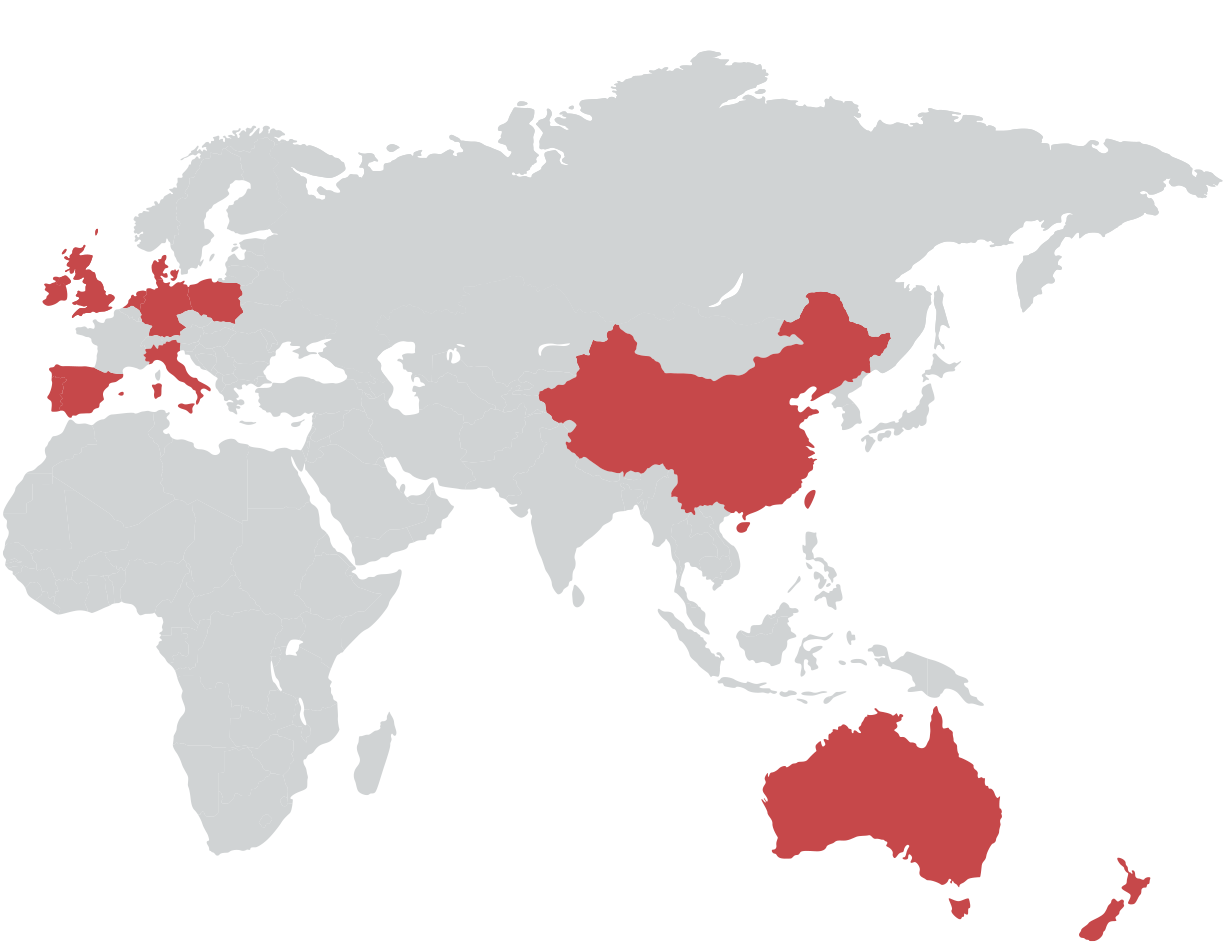

La nostra presenza nel mondo

Siamo una compagnia immobiliare internazionale equipaggiata per soddisfare le necessità dei nostri partner di capitali globali.

Sebbene la nostra rete ci consenta di ampliare la portata e la qualità delle opportunità in cui poter investire, restiamo concentrati e altamente selettivi quando si parla di mercati. Prendiamo le nostre decisioni tenendo in considerazione un’ampia gamma di fattori, tra cui il ciclo in cui si trova un mercato e la nostra capacità di strutturare un capitale al fine di ottimizzare i ritorni adeguati al rischio.

La chiave del nostro successo sono le nostre relazioni con i locatari. Riunioni faccia a faccia regolari ci permettono di soddisfare esigenze ed aspirazioni, permettendoci al contempo di analizzare periodicamente i nostri asset.

Il nostro Team

Il nostro team vanta ampia esperienza nei settori immobiliare, del private equity, bancario, legale e della conformità nei mercati di Asia-Pacifico ed Europa.

La partnership Arrows

Martyn McCarthy

Managing Partner

Kurt Wilkinson

Partner

Christian Bearman

Partner

Katherine Parker

Partner, Head of Investment Management Europe

Damian Horton

Partner, Asia-Pacific

Stuart Ross

Partner, Asia-Pacific

Robert Howe

Head of Real Estate, Europe

Ronan O’Donoghue

CFO

Danilo Hunker

Head of Germany

Martien van Deursen

Head of Benelux

Sam De Girolamo

Head of Italy

Notizie

Arrow Capital Partners nelle notizie nel mondo

Arrow and Cerberus nail down first deal of 2023 for €3bn platform

Arrow Capital Partners and Cerberus have completed their first deal this year for their €2bn Strategic Industrial Real Estate (SIRE) platform.

Arrow-Cerberus lease 81,076 sq ft at Aviator 80 in Ellesmere Port, Cheshire Arrow-Cerberus lease 81,076 sq ft at Aviator 80 in Ellesmere Port, Cheshire

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has leased Aviator 80, an 81,076 sq ft logistics property at Ellesmere Port in Cheshire. The asset is part of Arrow’s €3bn Strategic Industrial Real Estate (SIRE) joint venture with Cerberus.

Arrow boosts Dutch team with the appointment of Martijn Adelaar

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has appointed Martijn Adelaar as Senior Asset Manager in the Benelux team.

Arrow-Cerberus acquires logistics refurbishment project in Alcala de Henares, Madrid

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has acquired a 16,000 sqm logistics warehouse in Alcala de Henares for its €3billion Strategic Industrial Real Estate (SIRE) joint venture with Cerberus.

Arrow adds two more logistics assets to its Dutch SIRE portfolio

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has acquired two logistic assets in the Netherlands on behalf of its €3bn Strategic Industrial Real Estate (SIRE) joint venture with Cerberus. The assets were purchased in separate transactions for a total of c.€20 million.

Arrow bolsters team in Germany with two new hires

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has boosted its team in Germany with two new appointments in the Düsseldorf office.

Arrow confirms largest ever UK warehouse sale

Arrow Capital Partners has confirmed it has bought the Amazon-let warehouse facility at Wakefield Hub from Mountpark Logistics for £233m. React News revealed the impending sale of the warehouse in October in what is the largest price ever achieved for a single warehouse in the UK. Among the interested parties were LCN Capital Partners, Aviva Investors and Abrdn, as well as Korean and Malaysian investors.

Australian firm Arrow aims for last-mile delivery logistics

The real estate investor’s SIRE venture is set to invest €200 million in industrial and logistics properties in Ireland in the next year. Australian-headquartered real estate investor Arrow Capital Partners is confident of reaching its €200 million initial target of industrial and logistics properties in Ireland within the next 12 months. Cormac Dunne, head of Ireland at Arrow, told the Business Post that it is looking to acquire properties in the Greater Dublin Area and Cork as well as in Galway and Limerick.

Arrow buys two logistics assets for Dutch SIRE portfolio for €20m

Arrow Capital Partners has purchased two logistics assets in the Netherlands on behalf of its Strategic Industrial Real Estate (SIRE) joint venture with Cerberus for €20m. The assets, purchased in separate transactions, are Arrow’s first development projects in the Netherlands. The first is a last-mile, 14,445 sq m (155,000 sq ft) logistics development at Hoensbroek, which will be developed by Merle Vastgoed. It is prelet on a long-term lease to Fource, a distributor of car parts, lubricants and tools. The completed warehouse will include 12 loading docks, two level doors and will be constructed to a BREEAM Excellent rating.

Dell will move its Australian and New Zealand head office to The Zenith Towers in Chatswood, New South Wales.

Dell will close its three current New South Wales sites in Frenchs Forest, St Leonards and Macquarie Park, the tech giant said today in a statement. Zenith Towers is comprised of two towers with a central atrium and is owned by real estate company Arrow Capital Partners and global private investment firm Starwood Capital.

Starwood Capital, Arrow Capital JV recapitalizes properties in Australia

A joint venture between an affiliate of Starwood Capital Group and Arrow Capital Partners, an investor and operator of real estate, has entered into an agreement for the recapitalization of a portfolio of office and industrial assets alongside Altis Property Partners. The recapitalization will allow further investment in the portfolio and provide liquidity for some investors.

Arrow to develop 16,000m2 spec logistics facility in Madrid

Arrow Capital Partners has acquired a 30,000 m2 brownfield site in the Corredor de Henares in Madrid to speculatively develop into a 16,000 m2 logistics facility. Project Alcala is Arrow’s first build-to-own logistics development in Spain for its €3 bn Strategic Industrial Real Estate (SIRE) joint venture with Cerberus. Located within Madrid’s outer ring road, the new warehouse will meet strict sustainability criteria, including BREEAM ‘very good’ rating.

Arrow Capital buys €80m warehouse portfolio in maiden Nordic deal

Arrow Capital Partners has entered the Nordics with the acquisition of an €80m warehouse portfolio in Denmark. The European and Asia-Pacific real estate investor has bought the Lacus Portfolio of 10 warehouses on behalf of Strategic Industrial Real Estate (SIRE), the firm’s European industrial property investment fund backed by Cerberus Capital Management. Arrow Capital said the majority of assets are located in Copenhagen and the “Triangle Area” covering Vejle, Kolding and Fredericia. The 111,537sqm portfolio was acquired with 97% occupancy.

Arrow grows its German urban logistics portfolio

Arrow Capital Partners has acquired an 8,310m² urban logistics asset in Seevetal, south of Hamburg. Located on the strategically important Maschener Kreuz motorway junction between the A7, A39 and A1 highways, the asset is currently fully leased to a German furniture wholesaler. The property is split between two buildings that include 26 loading docks and four ground floor entry points.

Informativa sulla privacy

Arrow Property Investments Pty Ltd Privacy Policy

1) Objective

The purpose of this Privacy Policy is to demonstrate how Arrow Property Investments Pty Ltd (Arrow) implements practices, procedures and systems that ensure it complies with the Australian Privacy Principles (APPs) and provisions in the Privacy Act 1998 (Cth) (the Act) in relation to our collection, use, holding and disclosure of personal information and sensitive information.

2) Personal Information

Personal Information refers to information or an opinion about an identified individual, or an individual who is reasonably identifiable, regardless of whether it is true or recorded in a material form.

3) Sensitive Information

Sensitive information is personal information regarding an individual’s race, political opinion and affiliations, religious beliefs or affiliations, philosophical beliefs, membership of professional or trade unions or associations, sexual orientation or criminal record.

4) Collection of personal and sensitive information

Arrow will not collect personal information unless the information is reasonably necessary for one or more of its functions and activities. Further, sensitive information may only be collected if it is necessary and the individual consents to the collection.

All collection of personal information must be by fair and lawful means. Whenever it is reasonable and practicable to do so, Arrow will only collect personal information about an individual from that individual, and otherwise will take reasonable steps to ensure that the individual is made aware of the required matters.

Arrow may collect information about individuals’ visits to Arrow-owned websites using automatic collection tools, such as “cookies”. We do this in order to monitor traffic patterns and serve individuals more efficiently if they revisit the sites. Such tools do not identify individuals personally, but they can provide information such as the individuals’ browser type and language, access times, Internet Protocol addresses and behaviour (e.g. pages visited, links clicked).

5) Use and Disclosure of personal information

By use of this website you acknowledge that you are put on notice that Arrow may collect personal information. Arrow will use and/or disclose personal information for the primary purpose for which it was collected or received. Such primary purposes may include:

a) to deliver goods and services to Arrow’s clients or business partners, associates and other persons with whom we engage in business with;

b) to administer and improve the performance of Arrow-owned websites;

c) to address and respond to concerns or other correspondence from those who deal with us;

d) to provide information updates via email or social media platforms eg Instagram or Facebook.

Personal information may only be used or disclosed for the primary purpose for which it was collected. Using it for a secondary purpose is prohibited unless:

a) the individual has consented to that secondary purpose;

b) the individual would reasonably expect the disclosure or use for the secondary purpose which is related to the primary use; or

c) the secondary purpose is required or permitted by law

Arrow will never sell or rent personal information collected by it to third parties for marketing purposes.

Once the information is no longer of use to Arrow, and if there is no legal requirement to retain it, all reasonable steps will be taken to either destroy or de-identify the information.

6) Quality of Information

Arrow will take all reasonable steps to ensure that the personal information that it collects, uses and discloses is accurate, up to date and complete. We will also take steps to maintain and update that information when advised of incorrectness or change.

If an individual establishes that personal information which ARROW holds about him/her is not accurate, complete and up- to-date, Arrow will take all reasonable steps to correct the information.

7) Security of information

We have an obligation to take such steps as are reasonable in the circumstances to protect any personal information we hold from misuse, interference, loss, unauthorised access, modification or disclosure.

8) Access to information Individuals have a right to request access to their personal information and to request its correction by contacting Arrow via the contact details provided on our website. On request by a person, Arrow will take all reasonable steps to let the person know, generally, what sort of personal information it holds, for what purposes, and how it collects, holds, uses and discloses that information.

9) Cross border disclosure of information

Our use of data cloud storage means that data may be stored overseas. Customer information may only be accessed by employees of Arrow and will not be used for marketing purposes without specific prior permission.

Should personal or sensitive information be transferred or disclosed to overseas entities, it is the obligation of the discloser to take all reasonable steps to ensure that the receiving entity abides by the Australian Privacy Principles and the Privacy Act.

10) General

Arrow reserves the right to change this Policy from time to time, in accordance with relevant circumstances. If we do so, we will post the revised Policy here. We may also give notice by other means, such as a message on our website.

To obtain a copy of this policy please contact Arrow’s Privacy Officer by emailing

Any complaints, problems or queries regarding Arrow’s management of personal information should be directed to ARROW’s Privacy Officer by emailing

Termini

Thank you for visiting our website. This website is owned by Arrow Capital (ACN 610662274). By accessing and/or using this website and related services, you agree to these Terms and Conditions (Terms). You should review these Terms carefully and immediately cease using our website if you do not agree to these Terms. In these Terms, ‘us’, ‘we’ and ‘our’ means Arrow Capital and our related bodies corporate.

Accuracy, completeness and timeliness of informationThe information on our website is not comprehensive and is intended to provide a summary of the subject matter covered. While we use all reasonable attempts to ensure the accuracy and completeness of the information on our website, to the extent permitted by law, including the Australian Consumer Law, we make no warranty regarding the information on this website. You should monitor any changes to the information contained on this website.

We are not liable to you or anyone else if interference with or damage to your computer systems occurs in connection with the use of this website or a linked website. You must take your own precautions to ensure that whatever you select for your use from our website is free of viruses or anything else (such as worms or Trojan horses) that may interfere with or damage the operations of your computer systems.

We may, from time to time and without notice, change or add to the website (including the Terms) or the information, products or services described in it. However, we do not undertake to keep the website updated. We are not liable to you or anyone else if errors occur in the information on the website or if that information is not up-to-date.