Arrow Capital Partners

Private Real Estate Company

About Us

We specialise in value add and repositioning opportunities across multiple sectors and asset classes, investing both equity and debt.

Arrow Capital Partners is a private investment company specialising in commercial property value add and repositioning opportunities, investing equity and debt.

Arrow has 8 offices throughout Asia-Pacific and Europe, with assets under management of over $5b in real estate.

Positioned in the market as both an investor and operator, we seek out attractive investment opportunities and offer blended capital solutions, harnessing our personal capital, alongside that of our preferred investors.

Each partner at Arrow Capital has over 20 years’ global real estate experience, owning and managing some of the largest independent investment and asset management platforms in Asia-Pacific and Europe, and is well regarded amongst institutional and private equity investors across the globe.

Our Difference

We’re a partnership that’s entrepreneurial and disciplined in our investment and lending approach.

As a private partnership with commercial acumen, an understanding of macro trends, and local on-ground experience and expertise in each market we invest, we have the power to act decisively and can respond quickly to opportunities when they arise.

With significant personal investment in the projects we manage, our goals are highly aligned to those of our investor partners. This results in an unwavering focus on transparency and performance all the way through to exiting our investments.

Our Capabilities

We have a reputation for being responsive hands-on real estate investors and lenders.

Our ‘end-to-end’ real estate investment and management capabilities mean we’re actively involved in every stage of the process. From an equity perspective, from selecting assets to acquire and the creation, implementation and delivery of strategy and asset plans, right through to approvals of leases and capital expenditure.

From a lending perspective, to work with borrowers to understand their business plans, to structure loans accordingly and to provide relationship led support throughout the life of the loan.

The partners have overseen $15b of investment across the Asia-Pacific region, and $10b of investments and acquisition in Europe over the last nine years.

Arrow has a growing team of 50 investment, asset management, and finance professionals across Asia-Pacific and Europe.

We have established professional relationships with a range of investing partners including:

- Global institutions

- Private equity

- Fund managers

- Family offices

- Private investors

Types of Investment:

- Logistics investments

- Core plus and value add investments

- Fund launch and separate account mandates

- Residential Developments

- Management of international real estate investment management platforms

- Corporate activity

- Property development

- Office

Types of Lending / Credit Investing:

- Whole Term Loans

- Short Term

- Participating Capital

Filter location:

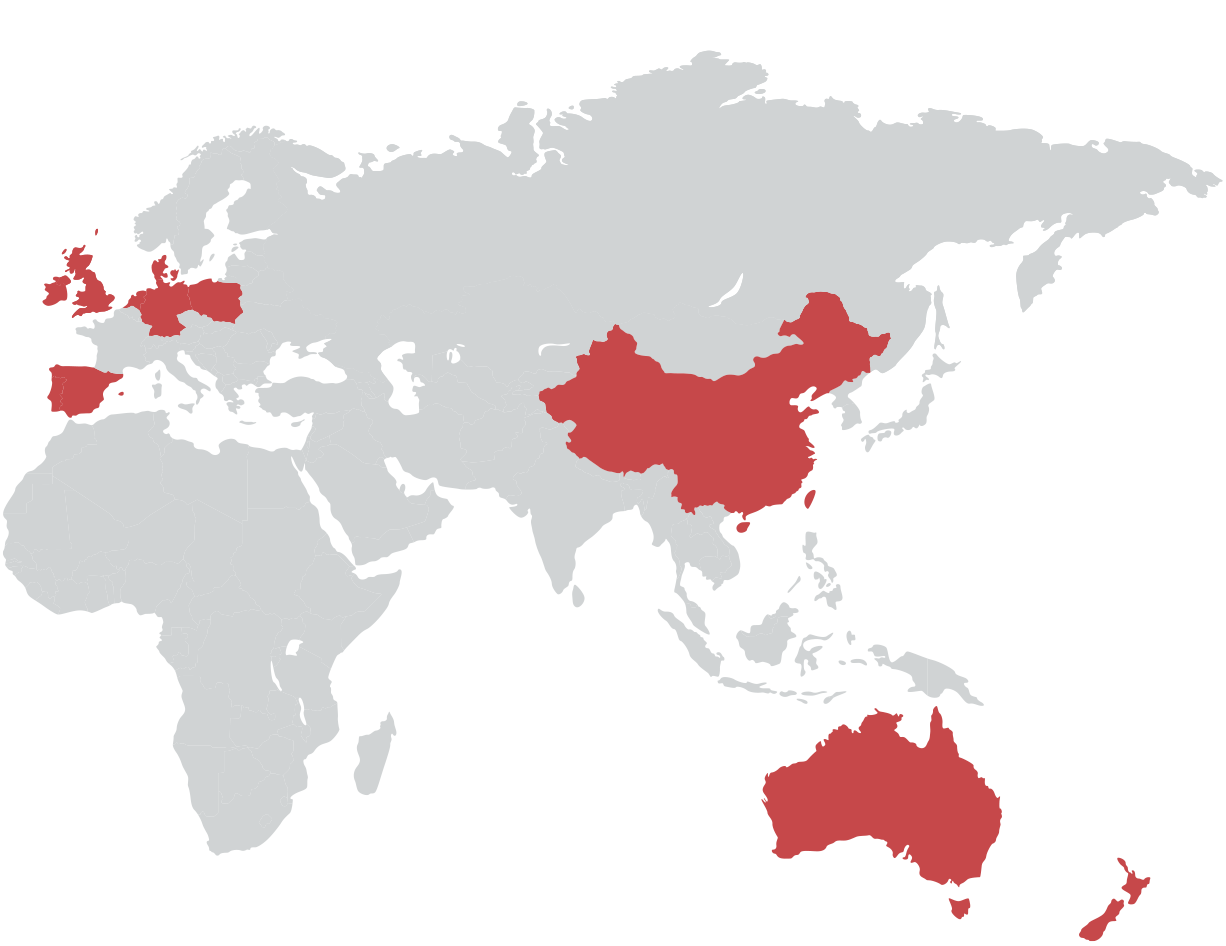

Our Global Presence

We are an international property company that is well positioned to meet the needs of our global capital partners.

While our network helps increase the breadth and quality of the opportunities we are able to invest in, we maintain our rigour and are highly selective when it comes to markets. Our decisions take into account a wide range of factors, including where in the cycle a market is, and our ability to structure capital accordingly to optimise risk-adjusted returns.

Our relationships with tenants are key to our success. Regular face-to-face meetings ensure we meet their needs and aspirations, while enabling us to inspect our assets on a regular basis.

Meet the Team

Our team has extensive experience in real estate, private equity, banking and legal and compliance across the Asia-Pacific and European markets.

The Arrow Partnership

Martyn McCarthy

Managing Partner

Kurt Wilkinson

Partner

Christian Bearman

Partner

Katherine Parker

Partner, Head of Investment Management Europe

Ronan O’Donoghue

CFO

Damian Horton

Partner, Asia-Pacific

Alexandra Lanni

Head of Credit, Europe

Cormac Dunne

Head of Real Estate, Europe

Martien van Deursen

Head of Benelux & Germany

Malgorzata de la Torre

Head of Spain

Stuart Ross

Partner, Asia-Pacific

In The News

Arrow Capital Partners global news

Arrow Capital Partners secures milestone lease at Arrow Park Ludwigsfelde

Arrow Capital Partners has secured its first lease at Arrow Park Ludwigsfelde, near Berlin. Pattonair, the global aerospace and defence supply chain provider, has taken 1,850 sq m of warehouse space on a 10-year lease. The signing of this lease highlights the quality of the units at Arrow Park Ludwigsfelde and demonstrates the strong demand for highly sustainable, modern space near major urban centres.

Q+A: Arrow’s Lanni on setting up a credit business, raising capital and not following the crowd

Earlier this month Arrow Capital Partners launched a new European credit business, recruiting Alexandra Lanni from CBRE Investment Management to lead the charge.

Arrow Capital Partners appoints Alexandra Lanni to lead European credit business

Arrow Capital Partners, the specialist investor, developer, credit provider and manager of real estate in Europe and Asia-Pacific, has appointed Alexandra Lanni to lead its European credit business.

Arrow Capital Partners appoints Cormac Dunne as Head of Transactions, Europe

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has appointed Cormac Dunne as Head of Transactions, Europe. In this role, Cormac will be responsible for originating investment opportunities across Europe, with particular focus on the UK, Netherlands, Spain, Germany, Nordics and Ireland, working closely with Arrow’s regional European heads and local teams to originate transactions for its five key growth strategies. Cormac will be based in Arrow’s London office.

Arrow Capital Partners expands investment management team in Asia-Pacific with the appointment of Jason Risorto

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has appointed Jason Risorto as executive of its Asia-Pacific investment management team.

Arrow Capital Partners acquires 20,000 sq m warehouse in the Netherlands

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has acquired a 20,000 sq m warehouse in Breda, the Netherlands, for its SIRE (Strategic Industrial Real Estate) joint venture with Cerberus.

SIRE plans to develop a 328,000 sq ft speculative logistics asset in Bolton

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, is working up plans to develop a 327,750 sq ft speculative logistics development adjacent to junction 6 of the M61. The site was acquired in 2020 for Arrow’s €3 billion SIRE (Strategic Industrial Real Estate) joint venture with Cerberus.

Arrow Capital Partners acquires 88,000 sq ft industrial asset in Dublin

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has acquired an 88,000 sq ft logistics asset in Dublin for €7.5 million. The acquisition was made for Arrow’s SIRE (Strategic Industrial Real Estate) joint venture with Cerberus

Arrow Capital Partners fully lets 4,700 sq m logistics asset near Schiphol

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has fully let its logistics asset at Pesetaweg 20 Nieuw-Vennep, near Schiphol, following the completion of a lease with three new tenants that has brought the rent back up to the market rate.

Arrow Capital Partners secures prime logistics lease in Valencia

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has let 7,159 sq m of warehouse space at its logistics asset in Alcàsser, Valencia.

Blueleaf Care homes in on Arrow Point, Crawley

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has signed a long-term lease with Blueleaf Care, the care home supplies and services provider, for Unit 1 at Arrow Point in Crawley.

Arrow Capital Partners completes 3,000 sq m of leases in Warsaw

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has completed two leases totalling 3,000 sq m at its logistics assets around Warsaw. Both leases were completed at assets acquired for Arrow’s Strategic Industrial Real Estate (SIRE) joint venture with Cerberus.

Arrow Capital Partners takes 21,000 sq m Eindhoven asset to full occupancy

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has let a combined 7,270 sq m of warehouse space at its logistics asset in Son en Breugel, just outside Eindhoven in the Netherlands, in two separate transactions.

Arrow Capital Partners promotes Malgorzata de la Torre to Head of Spain

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has promoted Malgorzata de la Torre to Head of Spain.

Arrow-Cerberus snaps up occupiers in Germany, leasing 34,807 sq m of logistics space

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has leased 34,807 sq m of logistics space across two properties in Germany. The leases were completed for Arrow’s Strategic Industrial Real Estate (SIRE) joint venture with Cerberus.

Arrow and Cerberus nail down first deal of 2023 for €3bn platform

Arrow Capital Partners and Cerberus have completed their first deal this year for their €2bn Strategic Industrial Real Estate (SIRE) platform.

Arrow-Cerberus lease 81,076 sq ft at Aviator 80 in Ellesmere Port, Cheshire

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has leased Aviator 80, an 81,076 sq ft logistics property at Ellesmere Port in Cheshire. The asset is part of Arrow’s €3bn Strategic Industrial Real Estate (SIRE) joint venture with Cerberus.

Arrow boosts Dutch team with the appointment of Martijn Adelaar

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has appointed Martijn Adelaar as Senior Asset Manager in the Benelux team.

Arrow-Cerberus acquires logistics refurbishment project in Alcala de Henares, Madrid

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has acquired a 16,000 sqm logistics warehouse in Alcala de Henares for its €3billion Strategic Industrial Real Estate (SIRE) joint venture with Cerberus.

Arrow adds two more logistics assets to its Dutch SIRE portfolio

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has acquired two logistic assets in the Netherlands on behalf of its €3bn Strategic Industrial Real Estate (SIRE) joint venture with Cerberus. The assets were purchased in separate transactions for a total of c.€20 million.

Arrow bolsters team in Germany with two new hires

Arrow Capital Partners, the specialist investor, developer and manager of real estate in Europe and Asia-Pacific, has boosted its team in Germany with two new appointments in the Düsseldorf office.

Arrow confirms largest ever UK warehouse sale

Arrow Capital Partners has confirmed it has bought the Amazon-let warehouse facility at Wakefield Hub from Mountpark Logistics for £233m. React News revealed the impending sale of the warehouse in October in what is the largest price ever achieved for a single warehouse in the UK. Among the interested parties were LCN Capital Partners, Aviva Investors and Abrdn, as well as Korean and Malaysian investors.

Australian firm Arrow aims for last-mile delivery logistics

The real estate investor’s SIRE venture is set to invest €200 million in industrial and logistics properties in Ireland in the next year. Australian-headquartered real estate investor Arrow Capital Partners is confident of reaching its €200 million initial target of industrial and logistics properties in Ireland within the next 12 months. Cormac Dunne, head of Ireland at Arrow, told the Business Post that it is looking to acquire properties in the Greater Dublin Area and Cork as well as in Galway and Limerick.

Arrow buys two logistics assets for Dutch SIRE portfolio for €20m

Arrow Capital Partners has purchased two logistics assets in the Netherlands on behalf of its Strategic Industrial Real Estate (SIRE) joint venture with Cerberus for €20m. The assets, purchased in separate transactions, are Arrow’s first development projects in the Netherlands. The first is a last-mile, 14,445 sq m (155,000 sq ft) logistics development at Hoensbroek, which will be developed by Merle Vastgoed. It is prelet on a long-term lease to Fource, a distributor of car parts, lubricants and tools. The completed warehouse will include 12 loading docks, two level doors and will be constructed to a BREEAM Excellent rating.

Dell will move its Australian and New Zealand head office to The Zenith Towers in Chatswood, New South Wales.

Dell will close its three current New South Wales sites in Frenchs Forest, St Leonards and Macquarie Park, the tech giant said today in a statement. Zenith Towers is comprised of two towers with a central atrium and is owned by real estate company Arrow Capital Partners and global private investment firm Starwood Capital.

Starwood Capital, Arrow Capital JV recapitalizes properties in Australia

A joint venture between an affiliate of Starwood Capital Group and Arrow Capital Partners, an investor and operator of real estate, has entered into an agreement for the recapitalization of a portfolio of office and industrial assets alongside Altis Property Partners. The recapitalization will allow further investment in the portfolio and provide liquidity for some investors.

Arrow to develop 16,000m2 spec logistics facility in Madrid

Arrow Capital Partners has acquired a 30,000 m2 brownfield site in the Corredor de Henares in Madrid to speculatively develop into a 16,000 m2 logistics facility. Project Alcala is Arrow’s first build-to-own logistics development in Spain for its €3 bn Strategic Industrial Real Estate (SIRE) joint venture with Cerberus. Located within Madrid’s outer ring road, the new warehouse will meet strict sustainability criteria, including BREEAM ‘very good’ rating.

Arrow Capital buys €80m warehouse portfolio in maiden Nordic deal

Arrow Capital Partners has entered the Nordics with the acquisition of an €80m warehouse portfolio in Denmark. The European and Asia-Pacific real estate investor has bought the Lacus Portfolio of 10 warehouses on behalf of Strategic Industrial Real Estate (SIRE), the firm’s European industrial property investment fund backed by Cerberus Capital Management. Arrow Capital said the majority of assets are located in Copenhagen and the “Triangle Area” covering Vejle, Kolding and Fredericia. The 111,537sqm portfolio was acquired with 97% occupancy.

Arrow grows its German urban logistics portfolio

Arrow Capital Partners has acquired an 8,310m² urban logistics asset in Seevetal, south of Hamburg. Located on the strategically important Maschener Kreuz motorway junction between the A7, A39 and A1 highways, the asset is currently fully leased to a German furniture wholesaler. The property is split between two buildings that include 26 loading docks and four ground floor entry points.

Privacy Policy

Arrow Property Investments Pty Ltd Privacy Policy

1) Objective

The purpose of this Privacy Policy is to demonstrate how Arrow Property Investments Pty Ltd (Arrow) implements practices, procedures and systems that ensure it complies with the Australian Privacy Principles (APPs) and provisions in the Privacy Act 1998 (Cth) (the Act) in relation to our collection, use, holding and disclosure of personal information and sensitive information.

2) Personal Information

Personal Information refers to information or an opinion about an identified individual, or an individual who is reasonably identifiable, regardless of whether it is true or recorded in a material form.

3) Sensitive Information

Sensitive information is personal information regarding an individual’s race, political opinion and affiliations, religious beliefs or affiliations, philosophical beliefs, membership of professional or trade unions or associations, sexual orientation or criminal record.

4) Collection of personal and sensitive information

Arrow will not collect personal information unless the information is reasonably necessary for one or more of its functions and activities. Further, sensitive information may only be collected if it is necessary and the individual consents to the collection.

All collection of personal information must be by fair and lawful means. Whenever it is reasonable and practicable to do so, Arrow will only collect personal information about an individual from that individual, and otherwise will take reasonable steps to ensure that the individual is made aware of the required matters.

Arrow may collect information about individuals’ visits to Arrow-owned websites using automatic collection tools, such as “cookies”. We do this in order to monitor traffic patterns and serve individuals more efficiently if they revisit the sites. Such tools do not identify individuals personally, but they can provide information such as the individuals’ browser type and language, access times, Internet Protocol addresses and behaviour (e.g. pages visited, links clicked).

5) Use and Disclosure of personal information

By use of this website you acknowledge that you are put on notice that Arrow may collect personal information. Arrow will use and/or disclose personal information for the primary purpose for which it was collected or received. Such primary purposes may include:

a) to deliver goods and services to Arrow’s clients or business partners, associates and other persons with whom we engage in business with;

b) to administer and improve the performance of Arrow-owned websites;

c) to address and respond to concerns or other correspondence from those who deal with us;

d) to provide information updates via email or social media platforms eg Instagram or Facebook.

Personal information may only be used or disclosed for the primary purpose for which it was collected. Using it for a secondary purpose is prohibited unless:

a) the individual has consented to that secondary purpose;

b) the individual would reasonably expect the disclosure or use for the secondary purpose which is related to the primary use; or

c) the secondary purpose is required or permitted by law

Arrow will never sell or rent personal information collected by it to third parties for marketing purposes.

Once the information is no longer of use to Arrow, and if there is no legal requirement to retain it, all reasonable steps will be taken to either destroy or de-identify the information.

6) Quality of Information

Arrow will take all reasonable steps to ensure that the personal information that it collects, uses and discloses is accurate, up to date and complete. We will also take steps to maintain and update that information when advised of incorrectness or change.

If an individual establishes that personal information which ARROW holds about him/her is not accurate, complete and up- to-date, Arrow will take all reasonable steps to correct the information.

7) Security of information

We have an obligation to take such steps as are reasonable in the circumstances to protect any personal information we hold from misuse, interference, loss, unauthorised access, modification or disclosure.

8) Access to information Individuals have a right to request access to their personal information and to request its correction by contacting Arrow via the contact details provided on our website. On request by a person, Arrow will take all reasonable steps to let the person know, generally, what sort of personal information it holds, for what purposes, and how it collects, holds, uses and discloses that information.

9) Cross border disclosure of information

Our use of data cloud storage means that data may be stored overseas. Customer information may only be accessed by employees of Arrow and will not be used for marketing purposes without specific prior permission.

Should personal or sensitive information be transferred or disclosed to overseas entities, it is the obligation of the discloser to take all reasonable steps to ensure that the receiving entity abides by the Australian Privacy Principles and the Privacy Act.

10) General

Arrow reserves the right to change this Policy from time to time, in accordance with relevant circumstances. If we do so, we will post the revised Policy here. We may also give notice by other means, such as a message on our website.

To obtain a copy of this policy please contact Arrow’s Privacy Officer by emailing

Any complaints, problems or queries regarding Arrow’s management of personal information should be directed to ARROW’s Privacy Officer by emailing

Terms

Thank you for visiting our website. This website is owned by Arrow Capital (ACN 610662274). By accessing and/or using this website and related services, you agree to these Terms and Conditions (Terms). You should review these Terms carefully and immediately cease using our website if you do not agree to these Terms. In these Terms, ‘us’, ‘we’ and ‘our’ means Arrow Capital and our related bodies corporate.

Accuracy, completeness and timeliness of informationThe information on our website is not comprehensive and is intended to provide a summary of the subject matter covered. While we use all reasonable attempts to ensure the accuracy and completeness of the information on our website, to the extent permitted by law, including the Australian Consumer Law, we make no warranty regarding the information on this website. You should monitor any changes to the information contained on this website.

We are not liable to you or anyone else if interference with or damage to your computer systems occurs in connection with the use of this website or a linked website. You must take your own precautions to ensure that whatever you select for your use from our website is free of viruses or anything else (such as worms or Trojan horses) that may interfere with or damage the operations of your computer systems.

We may, from time to time and without notice, change or add to the website (including the Terms) or the information, products or services described in it. However, we do not undertake to keep the website updated. We are not liable to you or anyone else if errors occur in the information on the website or if that information is not up-to-date.